Europe

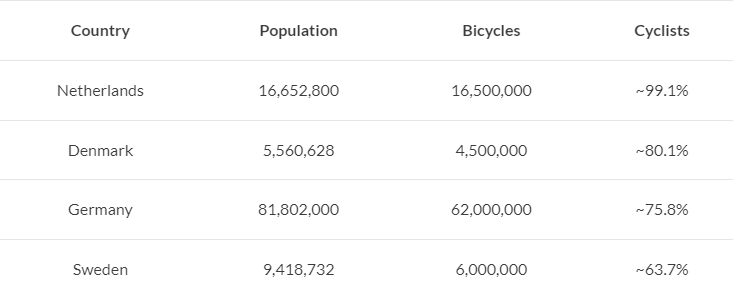

According to data from the Dutch Cyclists Association, the Netherlands stands as the country with the highest number of bicycle users worldwide. With approximately 2.3% of the one billion bicycles in the world, the Netherlands has gained a reputation for its remarkable cycling infrastructure and culture. A staggering 27% of all trips within the country are made by bicycle, reflecting the widespread acceptance of cycling as a convenient and healthy mode of transportation. The Dutch government has made significant investments in constructing dedicated cycling paths and facilities to support this thriving cycling culture.

Following the Netherlands, other countries have also embraced cycling as a popular means of getting around:

- Denmark: With 18% of trips being made by bicycle, Denmark boasts a remarkable cycling culture. The city of Copenhagen, in particular, earned the title of the world’s most bike-friendly city in 2015, showcasing its commitment to promoting cycling as a sustainable mode of transportation.

- Germany: Approximately 9% of trips in Germany are made by bicycle, and the average German cyclist covers 0.9 km per day. The country has recognized the importance of cycling and continues to invest in improving cycling infrastructure and facilities.

- Sweden: Sweden stands out with over 60% of its population identifying as cyclists, and approximately 12% of their daily trips are made by bicycle. The country’s commitment to cycling is reflected in the high number of individuals who actively choose cycling as their preferred mode of transportation.

- Spain: Spain has seen a growing interest in cycling, with approximately 20% of the population listing the bicycle as one of their modes of transport. Cities such as Valencia, Vitoria, and Zaragoza have witnessed a significant increase in cycling, prompting other cities to follow suit and invest in creating more bike-friendly roads and infrastructure.

These countries, along with the Netherlands, serve as shining examples of how prioritizing cycling and developing cycling-friendly environments can encourage more sustainable and healthier transportation choices.