Updates of Europe Defense Innovation as of June 2025

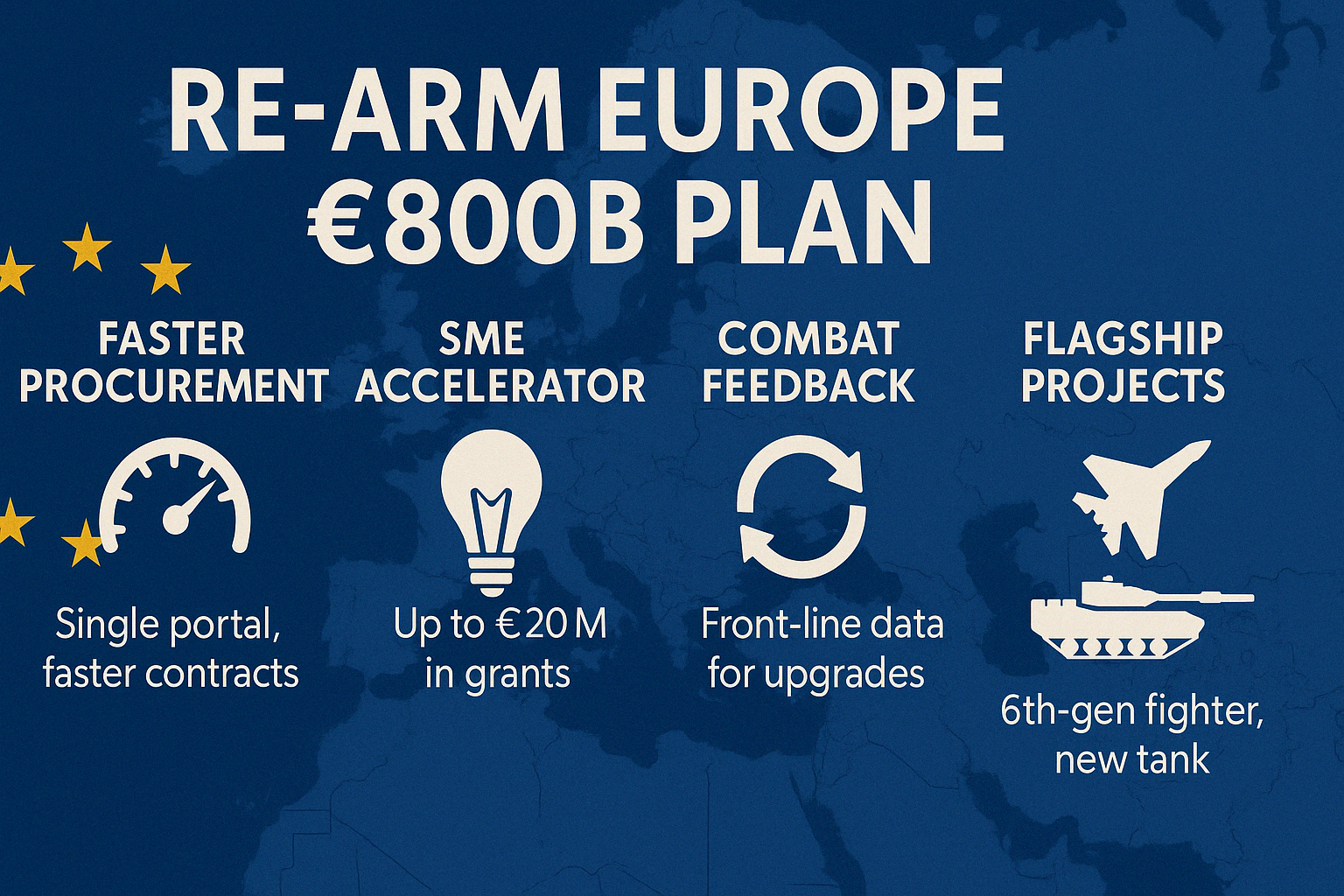

Europe’s €800 billion Re‑Arm plan is moving forward, aiming to boost defense across the continent through increased national spending and a €150 billion EU loan facility. The strategy supports key areas like air defense, drones, cyber, and logistics, while also encouraging more defense-friendly fiscal rules and investment tools.

They are stepping up its defense efforts with a new €1.5 billion program aimed at boosting its own military industry. The plan pushes for at least 65% of components to come from inside the EU and includes new measures to cut red tape and speed up defense projects. It’s a clear move toward more self-reliance and quicker response times in a changing security landscape.

From the 24th of June until the 25th, NATO allies got together for a major summit in The Hague, but not everyone was on the same page. Spain’s Prime Minister called a proposed 5% GDP defense spending target “unreasonable,” saying 2% is more realistic. The meeting focused on collective defense, Ukraine support, and getting allies aligned on military investment.

The key takeaways from the summit included a landmark commitment by all NATO members to increase defense spending to 5% of GDP by 2035. Leaders reaffirmed NATO’s ironclad Article 5 pledge, underscoring strengthened transatlantic unity. The alliance also placed a stronger emphasis on supporting Ukraine—not only through military aid but also via industrial and equipment support. Additionally, members agreed to boost cooperation in cybersecurity, hybrid threats, and defense innovation. Notably, the United States played a pivotal role in driving consensus around the 5% commitment, with former President Trump making a major push for the deal. Dutch Prime Minister Mark Rutte hailed it as a “historic agreement.” Following his meeting with President Zelensky, Trump stated that he intends to engage in dialogue with Vladimir Putin in an effort to help bring the conflict in Ukraine to an end.

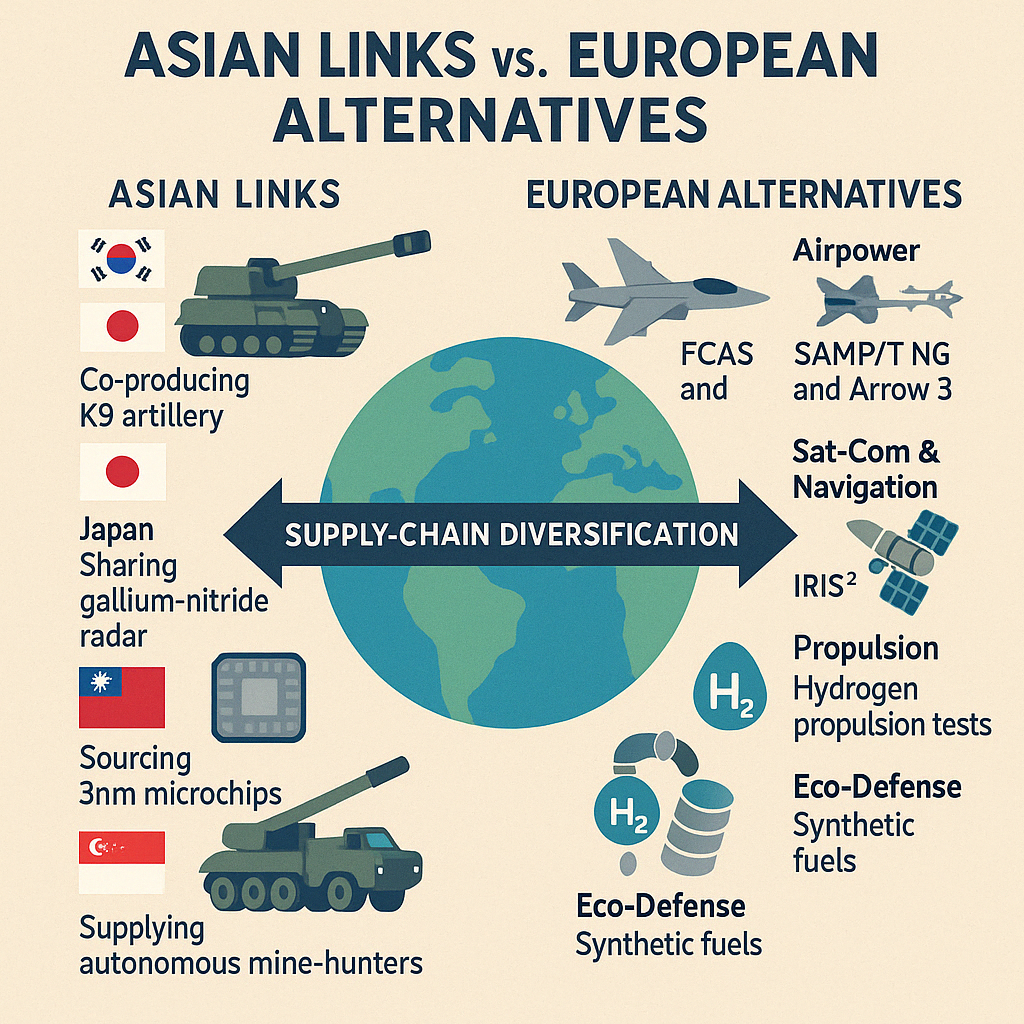

Meanwhile, defense tech is taking the spotlight. The 2025 Paris Air Show was a strong display of aerospace innovation and international collaboration. Major defense and aviation companies unveiled new aircraft, tech, and deals, with a clear focus on sustainability and military modernization. France stood out with key announcements, including a €1 billion satellite deal with Eutelsat. The event highlighted Europe’s push for defense autonomy and growing interest in space and dual-use technologies.